Reclaiming Value in Equipment Finance: 2025 Operations Trends You Can’t Afford to Miss

Did you know that equipment finance organizations are losing up to 5% of their net investment at end-of-term due to manual renewals and residual leakage? That’s margin left on the table at a time when compliance costs and credit scrutiny are rising.

Our new 2025 Equipment Finance Operations Trend Brief uncovers where inefficiencies are eroding profitability—and where leading lessors are investing to reclaim value.

Why This Brief Matters

Equipment finance leaders face an increasingly complex operating environment:

Revenue leakage from mis-billed rentals, delayed buy-out invoices, and unclaimed pass-throughs

Protracted month-end closes, with 60% of lessors needing 8+ business days to finalize books

Automation gaps that leave core workflows trapped in spreadsheets

Mounting regulatory pressure, with 90% of compliance leaders expecting greater CECL/OCC scrutiny through 2027

The opportunity? Free your team from low-value, manual work and redeploy resources toward credit analytics, residual optimization, and growth initiatives.

What You’ll Learn Inside

The two-page brief distills:

Benchmark statistics on efficiency, automation, and compliance

Emerging automation quick wins for credit, booking, and end-of-term renewals

Where high-growth lessors are directing investments—from workflow automation to embedded AI & analytics

A 90-day playbook for surfacing quick wins and accelerating transformation

From Pain Points to Competitive Advantage

The brief doesn’t just outline challenges. It shows how forward-looking equipment finance firms are:

Building unified asset-level data layers to eliminate reconciliation headaches

Embedding AI-driven insights for delinquency prediction and residual forecasting

Leveraging cloud-native ecosystems for scalability across growing portfolios

Download the Brief Today

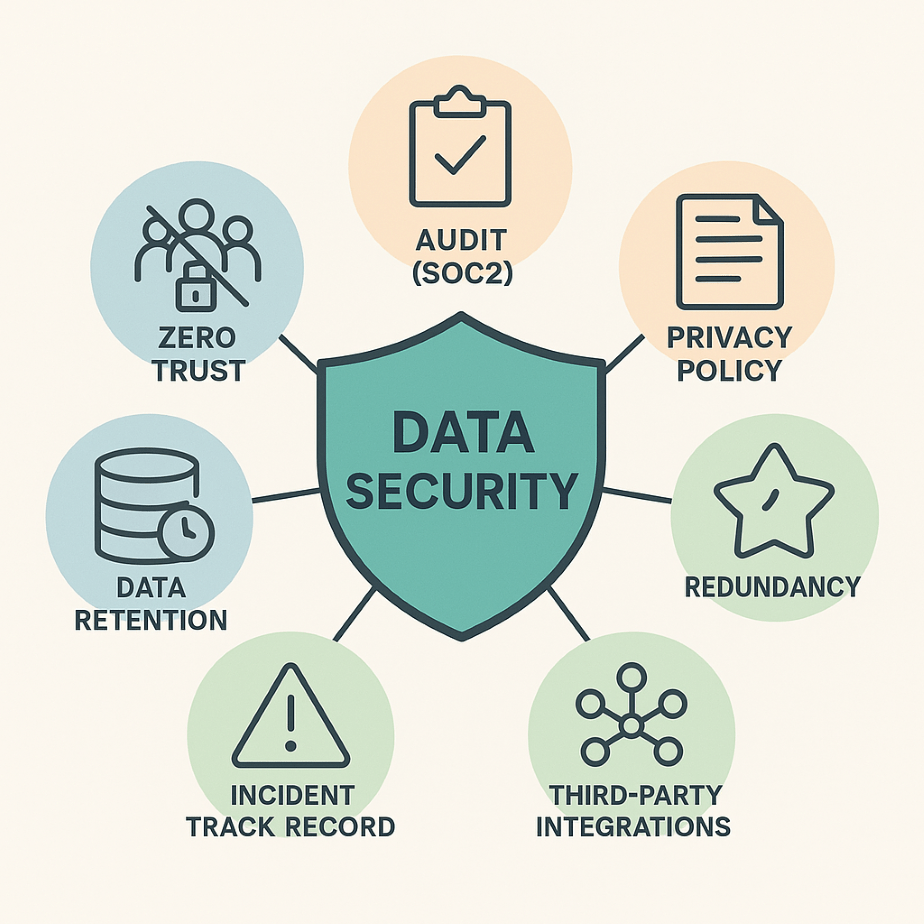

If your finance team is spending too much time reconciling spreadsheets, chasing renewals, or preparing for audits, this resource is for you.