Meet Ken Walsh, Constellation Financial Software’s resident expert on technology, product development, and innovation. We sat down to talk all things tech, software, and the future of equipment finance.

Q: Why don’t you tell us about yourself, and your life in technology?

Ken: I graduated from Wilfrid Laurier University back in 2003 with a Bachelor of Science in Computer Science. After graduation I was offered a full-time position with APAK Systems (which was later bought by Constellation Software). When I started as a junior software developer, I was fascinated with system performance topics. This drew me to the data conversion as well as how our financial engine worked. I worked with both to implement performance improvements and over the course of years reworked both. The product team and I worked together to re-architect the engine, cutting processing times by half, as well as designing a fully automated, and multi-threaded data conversion process which is still in use today.

While working on the data conversions, I would be engaging with new clients to write custom data extraction routines from their legacy systems. This gave me the opportunity to learn multiple different businesses inside and out. I worked with individuals who had decades of experience in the industry, and was exposed to all aspects of equipment finance.

My focus soon shifted from doing the actual development work to finding ways to translate my industry knowledge into technology innovation through product development.

Q: Tell me about some of the evolution in technology and data science you’ve seen over the last ten years.

Ken: Ten years ago, the conversation was really more so about Big Data. We knew that the information we were gathering was immensely valuable, but the difficulty was that the sheer volume of data that was collected made its interpretation extremely difficult. It turned out to be a true investment in the future, because with the newest iteration of AI, it’s now possible to use that data to guide decisions. AI can identify patterns, correlations, anomalies, and trends in the data to guide future actions.

Q: What challenges do you think equipment finance companies will face in implementing new technology like AI?

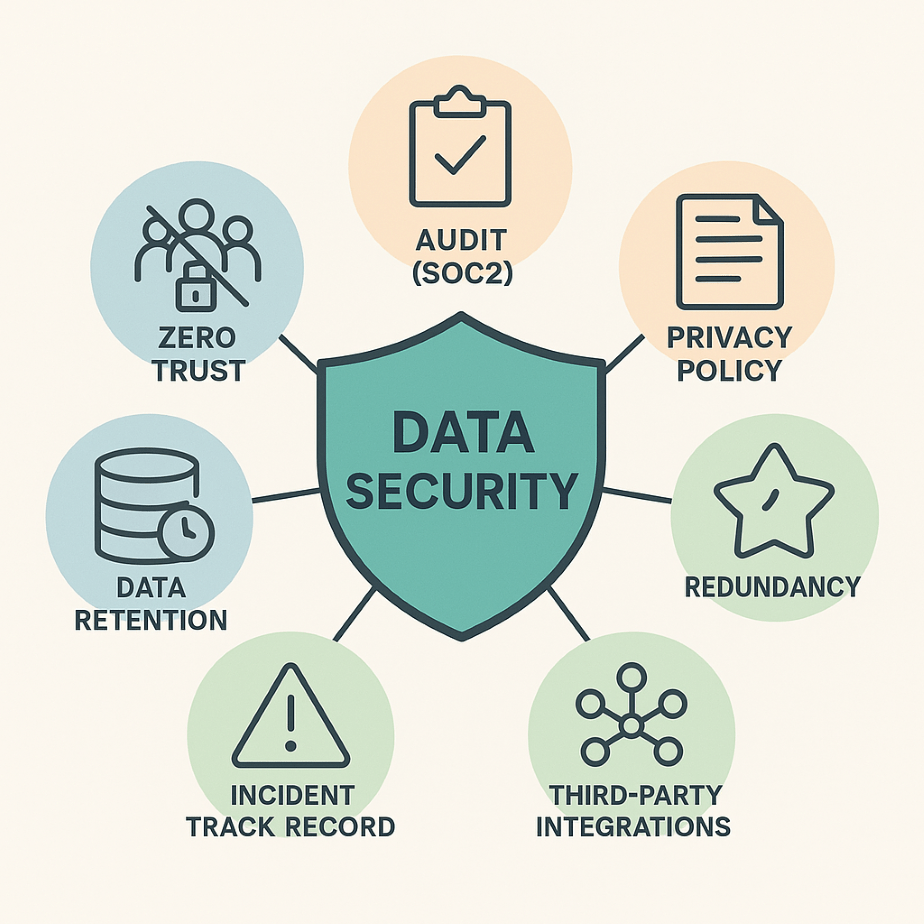

Ken: I think the largest issue Equipment Finance companies will face adapting AI into their organization will be both securing their data, as well as dealing with AI Hallucinations and Bias.

When using AI, a user needs to train the AI model to work with their industry as well as their own client base for any answer provided by AI to be useful. When you tie AI to both your own data sources as well as the public web you can get a very powerful tool to work with your team. The answers will be reasonable, however the draw back to this is that because you are updating a public AI model, other companies have access to your training. Many AI companies offer a closed AI model, such as Microsoft Co Pilot, which means some questions about modern trends are outside of its access levels. The complexity lies in how to keep your AI up to date with the information you need it to have to be useful, while at the same time balancing how secure you need it to be. There are so many options to secure your data, as well as make the AI useful, the challenge is where your implementation has to fall on the spectrum.

Once you know how much security you need for your AI, the task you want to give the AI needs to be reviewed to determine how accurate does the AI need to be to do the task. Current AI chat bots such as Co Pilot and ChatGPT, can have some very complex chats with a user offering some good data back to the user, however in some cases the AI bot will hallucinate the answer, and it will give you this answer with confidence. ChatGPT has been known to make up an answer if the question is vague and the specific resource on the internet is not available. You can correct the bot, and it would apologize, however if you used the wrong data in your decisioning process, then you would have an issue. With the hallucinations, AI bots will have inherent bias based on what data they have access to. As an example, in your database there may be data that shows 20% of white males between the ages of 30 to 40 have been defaulting on loans this month. AI will take that and count that as a negative for the next time a white male between 30 to 40 applies. However, this could have been because a local company went out of business and had nothing to do with the gender or age.

To work around these challenges, it is important that the person implementing the AI knows how much of the AI model is secured and what is not, as well as understanding that AI is a very powerful tool, and it has a very bright future, but for the foreseeable future it will be a tool to aid someone and will not be a replacement for a flesh and blood employee.