Understanding the FTC Safeguards Rule

Fundamentally, the FTC Safeguards rule is about how you store and protect your customers’ data. The last ten years have seen a tightening of regulations related to cybersecurity, data collection, and privacy on a global scale, so it’s no surprise that new Federal Trade Commission regulations should dictate how financial institutions be required to safeguard consumer data.

Now, we know what you’re thinking. The FTC Standards for Safeguarding Customer Information has been in place since 2001, so why are we talking about it now? The simple answer is that technology, and by extension, the rules that govern it, has changed since then. The FTC amended the Safeguards Rule in 2021 to better reflect, and keep pace with, modern technological evolution.

The Basics

The FTC Safeguards Rule, and by extension, its recent amendment, applies to a few key areas:

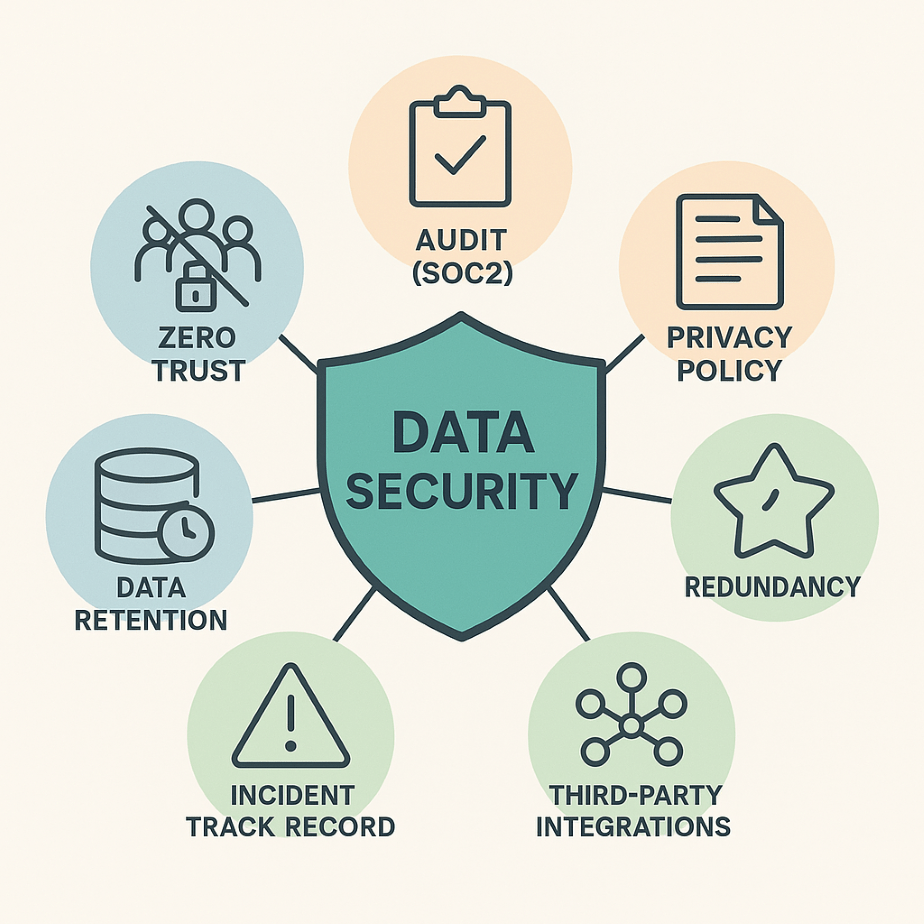

Data Security: The primary objective of the Safeguards Rule is to ensure the security of consumers’ nonpublic personal information. This means your business needs to establish safety measures to protect personal information from unauthorized access or disclosure.

Risk Assessment: The rule mandates financial institutions to conduct a thorough risk assessment to identify and evaluate potential security risks, so that they can then develop and implement appropriate safeguards based on their specific needs.

Data Access Control: Access to consumer information must be limited to authorized personnel only. Financial institutions are obligated to implement controls to restrict access and regularly monitor who has access to this sensitive data.

Employee Training: Properly trained employees are essential for maintaining data security. The Safeguards Rule emphasizes the importance of educating staff about the institution’s security policies and procedures.

Regular Monitoring and Adjustments: Institutions must continuously monitor their security measures and make necessary adjustments to adapt to evolving threats. This involves keeping software and hardware systems up to date and staying informed about the latest cybersecurity developments.

How Can I Ensure My Business Is In Compliance with FTC Safeguard Requirements?

Compliance involves the following:

- Designation of an Information Security Program: Institutions must appoint an individual or committee responsible for the development, implementation, and oversight of the institution’s information security program.

- Execution of a Risk Assessment Plan: Conduct a risk assessment to identify vulnerabilities and assess the potential risks to consumer data.

- Implementing Security Safeguards: Based on the risk assessment, implement appropriate safeguards to protect consumer information. These safeguards may include encryption, access controls, and data backup procedures.

- Deploy an Employee Training Program: Ensure that all employees are adequately trained in data security and privacy policies. This, in particular, can be outsourced to companies that specialize in providing this type of training.

- Regular Monitoring and Updates: Continuously monitor and update security measures to adapt to new threats and vulnerabilities.

What should go without saying is that choosing the right technology stack for your business is essential if you want to be, and stay, compliant.

Reach out to our team today. We can help you stay on track.