The loan management process is an essential aspect of any lending organization, involving a series of steps, starting from loan origination to repayment and beyond. Over the years, the loan management process has become increasingly complex, making it challenging for lenders to manage their loan portfolio effectively. This is where loan management software comes into play.

Loan management software can offer a solution that streamlines the process for lenders in the asset finance industry, making it easier and more efficient and providing a centralized platform for managing all loan-related activities, thereby reducing the risk of errors and increasing transparency.

Key benefits of a comprehensive loan management software include:

Automation: By automating various tasks, such as loan application processing, document management, and loan servicing, lenders can save time, money and resource.

Increased Efficiency: When manual processes are reduced, you also reduce the time and effort required to manage loans. This results in increased efficiency and cost savings for lenders.

Improved Data Management: Having a centralized platform for managing loan data means that you can ensure that all information is accurate, up-to-date, and accessible in real-time. This reduces the risk of errors and increases transparency, leading to improved decision-making.

Enhanced Customer Experience: Loan lifecycle software provides a user-friendly interface for customers, making it easy for them to apply for loans and manage their loan information. This enhances the customer experience and increases customer satisfaction.

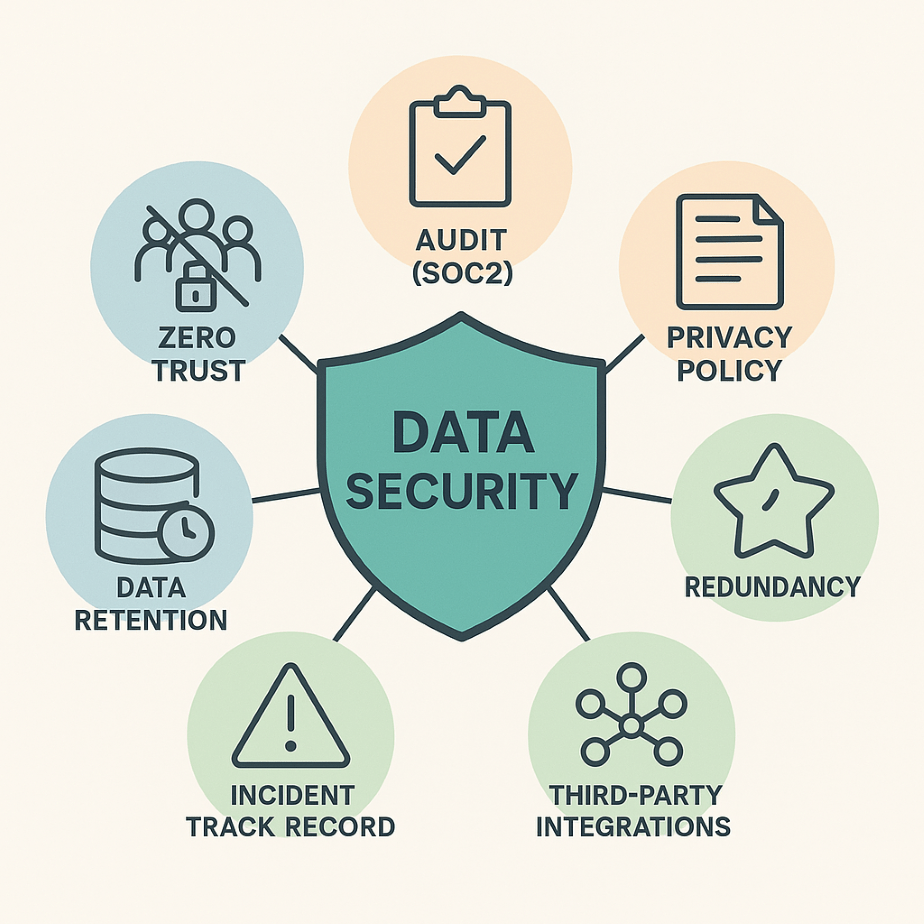

Compliance: With regulations continually evolving, software can help lenders regulations by automating compliance checks and providing real-time monitoring and reporting. This reduces the risk of non-compliance and protects lenders from costly penalties.

Why choose Constellation Financial Software?

We built an innovative platform that provides a seamless end-to-end loan management solution, tailored to meet the unique needs and requirements of your business.

With its advanced technology and automation capabilities, our platform streamlines the entire loan lifecycle, from loan origination to repayment and beyond. This helps to achieve optimal operational efficiency, reducing the time and effort required to manage loans, and freeing up resources to focus on more critical tasks.

The asset finance industry is heavily regulated, and our software helps lenders to comply with these regulations by providing a complete and auditable record of all loan transactions. This helps lenders to demonstrate their compliance and reduces the risk of penalties and fines. With the benefit of real-time monitoring and reporting features, you can be confident that your loan portfolio is being managed in accordance with the latest regulations and guidelines.

The software is built to be scalable, allowing it to adapt as your needs change over time. Whether you need to manage a small loan portfolio or a large and complex one, it can be customized to fit your specific requirements. This flexibility ensures that the software will be able to meet your needs now and in the future, as your business grows and evolves.

As the business and loan environment becomes increasingly complex, the use of loan management software is likely to become more widespread, and the need for effective, comprehensive solutions that meet the growing needs of the finance and wider business sector will become increasingly important.